Money has been humanity’s companion through millennia, shaping societies and reflecting our collective aspirations. From simple exchanges of goods to permissionless digital tokens, its journey reveals the power of innovation to transform lives.

Understanding this history not only enriches our appreciation of money’s role but also equips us to navigate today’s rapidly evolving financial landscape.

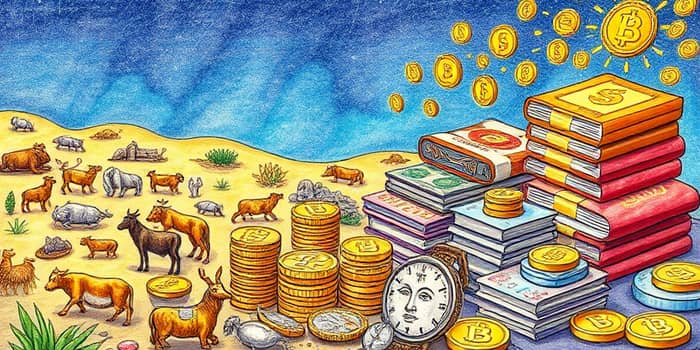

In the earliest human settlements, trade depended on direct swaps of livestock, grains, and other commodities. Barter was effective within small communities but became unwieldy as societies grew more complex.

The first step toward a universal medium of exchange emerged when people recognized the need for rapid, efficient, simple, and secure ways to trade beyond immediate neighbors.

Standardized items like cattle and sacks of grain carried agreed-upon value, laying the groundwork for future innovations.

As civilizations advanced, portable and durable forms of money became essential. Around 1200 B.C., cowrie shells circulated widely, prized for their consistency and portability.

By 1000 B.C., China began casting bronze and copper imitations of cowries, marking the dawn of metal coinage. A few centuries later, Greek and Persian city-states produced stamped silver coins, often bearing images of gods and emperors.

These metallic currencies solved problems of bulkiness and inconsistency, introducing fixed quantities, standardized values, and ease of transport. Gold and silver coins became the backbone of international trade for centuries.

Paper money first appeared in China during the Tang dynasty, evolving from merchant receipts to government-issued banknotes by the 9th century. Leather notes had even circulated centuries earlier.

These innovations faced fierce counterfeiting challenges, inspiring ever-more sophisticated printing techniques and security features.

In medieval Europe, goldsmiths in London issued promissory notes that functioned like modern banknotes. By the 19th century, thousands of private and state banks in America printed their own currencies, fueling commerce but also occasional panics.

Simultaneously, credit money emerged as people deposited cash and wrote checks, creating new forms of purchasing power beyond physical coins and notes.

The late 20th century marked a leap toward digital finance. In 1983, cryptographer David Chaum introduced eCash, pioneering blind signatures for interaction to ensure privacy and security online.

Chaum’s DigiCash venture in the 1990s laid further groundwork, even as it struggled with market adoption. In 1998, Wei Dai’s concept of b-money and the very term “cryptocurrency” redefined what money could be—decentralized and trustless.

The 2008 financial crisis exposed vulnerabilities in centralized systems and fueled demand for alternatives. That same year, Satoshi Nakamoto’s Bitcoin whitepaper presented a peer-to-peer electronic cash system, embedding a critique of bank bailouts into its genesis block.

Bitcoin’s launch in 2009 demonstrated a live, working currency independent of any institution. Next came proof-of-stake models, Ethereum’s smart contracts, and a vast ecosystem of altcoins exploring governance, privacy, and scalability.

In our digital age, understanding and leveraging modern money systems is essential. Here are practical ways to navigate the evolving landscape:

By taking these steps, individuals can harness the power of new financial technologies while preserving their legacy wealth in reliable forms.

As we stand at the intersection of centuries-old traditions and groundbreaking digital innovations, money’s journey is far from over. Emerging technologies like central bank digital currencies (CBDCs), decentralized finance (DeFi), and tokenized assets promise to reshape how we transact, invest, and trust one another.

These advancements hold the key to an accessible, transparent, and inclusive financial future where borders blur and opportunities expand.

This ongoing transformation calls for agility, curiosity, and a commitment to secure practices. By embracing change, we become active participants in crafting a more accessible, transparent, and inclusive financial future—one where everyone can engage with confidence.

The legacy of money is not merely in coins and banknotes but in the ideas that drive human progress. From barter to blockchain, each innovation reflects our pursuit of efficiency, equity, and empowerment. Let this journey inspire you to explore, adapt, and contribute to the next chapter in the ever-evolving story of money.

References